Understanding 3% Credit Card Surcharge Rates for Auto Repair Shops

In today’s competitive automotive service industry, every penny counts. Auto repair shops face rising costs in parts, labor, insurance, and overhead—making it increasingly important to manage payment processing fees. One growing trend among auto repair businesses is implementing a 3% credit card surcharge to cover the cost of accepting credit card payments. While this can be a smart financial move, it’s essential for shop owners to understand how surcharges work.

Automotive SmartPay will show you how to implement them. We also offer a low 0.35% interchange pricing model instead of surcharge.

What Is A Credit Card Surcharge?

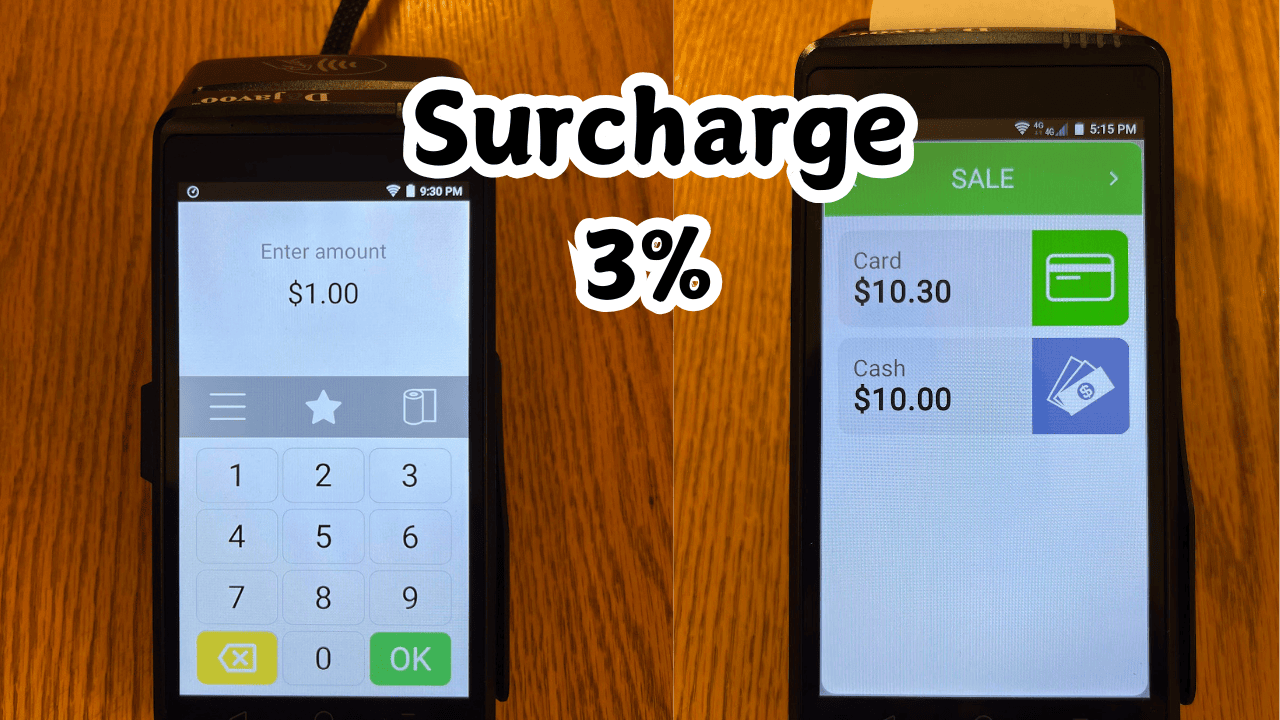

A credit card surcharge is an additional fee charged to a customer who chooses to pay with a credit card. For many auto repair shops, these fees can add up quickly, cutting into already thin profit margins.

By adding a 3% surcharge, an auto repair business can pass the cost of credit card processing directly to the customer, keeping their service prices consistent across all payment types. However, it’s crucial to understand the difference between a surcharge and a cash discount—a surcharge adds a fee for credit card use, while a cash discount offers a lower price for paying with cash or debit.

Please note, there is no surcharge for debit cards as the system will treat the transaction as a cash price.

How Much Your Business Can Save:

With a 4% rate savings, your monthly credit card processing fees could be reduced to nearly zero

| Mo Card Volume: | Mo Savings | 1 Year Savings | 5 Year Savings |

|---|---|---|---|

| $5,000 | $200 | $2,400 | $12,000 |

| $10,000 | $400 | $4,800 | $24,000 |

| $20,000 | $800 | $9,600 | $48,000 |

| $50,000 | $2,000 | $24,000 | $120,000 |

| $100,000 | $4,000 | $48,000 | $240,000 |

| $250,000 | $10,000 | $120,000 | $600,000 |

| $500,000 | $20,000 | $240,000 | $1,200,000 |

Why Auto Repair Shops Are Adding Surcharges

Auto repair shops are especially impacted by credit card fees due to the high average ticket price for services like engine repairs, brake replacements, or transmission work. With individual transactions often totaling hundreds—or even thousands—of dollars, the cost to accept credit cards becomes a significant expense.

For example, a $1,000 repair job paid by credit card could cost the shop $30 in processing fees. If the shop performs 100 similar transactions in a month, that’s $3,000 in fees—money that could otherwise go toward employee wages, tools, or shop improvements.

Implementing a 3% credit card surcharge allows automotive repair businesses to:

- Maintain their current pricing structure

- Avoid raising prices across the board

- Improve profit margins

Automotive SmartPay will help you with this easy transition.

Get Your Auto Shop Business The Dual Pricing Edge

✔️ NO

Contract

✔️ Next

A.M. Funding

✔️ Free

Machine

✔️ NO

PCI Fees

Best Practices for Implementing a Surcharge

No Processing Fees For Your Auto Shop

For auto repair shops considering a credit card surcharge, transparency is key. Communicate the fee clearly to avoid misunderstandings or customer dissatisfaction.

Here are a few tips:

- Consider offering an incentive for cash payments to balance customer options

- Display signage near the register or service desk explaining the surcharge

- Train staff to explain the reason for the fee politely and professionally

- Include the surcharge as a separate line item on the receipt

States Where Surcharge Is Not Allowed:

- Connecticut

- Maine

- Massachusetts

- New York

- California (effective July 1, 2024 under “junk fee” legislation)

- Texas (state law still prohibits surcharges, but unenforceable despite ongoing legal challenge)

If your auto shop wants a simpler and more customer friendly solution, we recommend using Dual Pricing instead. This is what gas stations have been doing for years with credit card and cash prices.

Get Set Up With Surcharge For Your Auto Shop Today

Adding a 3% surcharge for credit card payments is becoming a common and accepted practice for many auto repair shops. It allows businesses to stay profitable without increasing service prices for all customers. By staying compliant with regulations and communicating clearly, auto repair automotive shops can successfully implement a surcharge strategy that supports their bottom line while maintaining customer trust.

Whether you’re a small garage or a large auto service center, understanding credit card surcharges can help drive smarter financial decisions—and keep your shop running smoothly.

Hello, my name is Greg G. Kapitan, and I represent Automotive SmartPay—pictured here with my wife, Michelle. I’m available by call or text anytime at 801-205-1955 to answer your questions and help you get started.